Embarking on a Thai foreign company setup is an exciting venture for investors looking to tap into Southeast Asia’s dynamic market. The process, however, can seem complex, with specific legal requirements and procedures. Furthermore, the pathway differs significantly depending on the nationality of the shareholders. American citizens, for instance, benefit from a unique treaty that simplifies 100% ownership. This guide provides a clear, step-by-step process for establishing your company in Thailand, comparing the advantages for U.S. investors against the standard process for other foreign nationals.

Understanding Ownership: Treaty of Amity vs. FBL for Your Thai Foreign Company Setup

Before diving into the procedural steps, it is crucial to understand the two primary legal frameworks that govern foreign business ownership in Thailand.

For U.S. Shareholders: The Treaty of Amity

The Treaty of Amity and Economic Relations between the United States and Thailand is a significant advantage for American investors. Under this treaty, U.S. citizens and entities are granted “national treatment,” meaning they can own and operate a 100% American-owned company in Thailand and engage in a wide range of business activities on the same basis as Thai nationals. Consequently, this exempts them from most of the restrictions of the Foreign Business Act (FBA), making the Thai foreign company setup process more straightforward.

For Other Nationalities: The Foreign Business License (FBL)

Investors from other countries must typically navigate the Foreign Business Act (FBA). To operate a 100% foreign-owned business in a restricted category, they must apply for and be granted a Foreign Business License (FBL). The FBL application process is considerably more rigorous and discretionary. It requires a detailed business plan, proof of benefits to Thailand, and a higher level of scrutiny from the Ministry of Commerce.

The Step-by-Step Process for Your Thai Foreign Company Setup

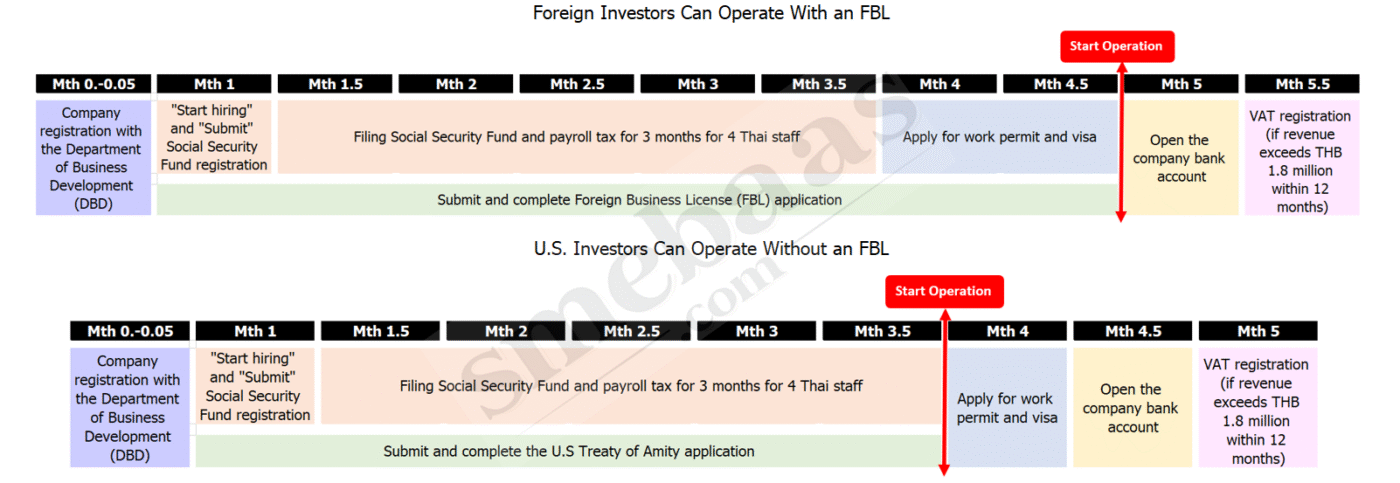

Here is the chronological procedure for registering and launching your foreign-owned company in Thailand. The core registration steps are similar for all, but the crucial licensing stage (Step 4) is where the paths diverge.

Step 1: Company Registration with the Department of Business Development (DBD)

The foundational step is to legally register your company limited. This involves preparing and submitting a series of documents to the Department of Business Development. Notably, the company must meet a minimum capital requirement.

Step 2: Hiring Staff & Social Security Registration

Once your company is registered, you must register with the Social Security Fund (SSF) within 30 days of hiring your first employee. This is a mandatory step for providing employee welfare benefits. For a Thai foreign company setup, this is also a prerequisite for the foreign director’s work permit application.

Step 3: Monthly Social Security and Payroll Tax Filings

This is an ongoing operational requirement but crucial to set up correctly from the beginning. To maintain good standing and comply with Thai law, your company must file payroll records and social security contributions monthly.

Step 4: Submit Business License Application (FBL or Treaty of Amity)

This is the pivotal step that differentiates U.S. investors from others.

-

- For U.S. Shareholders (Treaty of Amity): You will apply for a Foreign Business Certificate under the Treaty. This is generally a verification process rather than a discretionary approval.

-

- For Other Nationalities (FBL): You will submit a full FBL application, which is a more complex and lengthy process involving a review by the Foreign Business Committee.

Step 5: Apply for Work Permit and Visa

With the company and initial compliance in place, the foreign director or employee can apply for a Non-Immigrant “B” (Business) visa and a work permit. The company must be able to support this application. You can explore more about Thai visa requirements on our Visa and Work Permit Services page.

Step 6: Open a Corporate Bank Account

After receiving the company registration documents and tax ID, you can open a corporate bank account. This account is essential for all business transactions, including receiving investment capital and paying expenses.

Step 7: VAT Registration

Finally, if your company’s revenue is projected to exceed 1.8 million THB within a 12-month period, you must register for Value Added Tax (VAT) with the Revenue Department. This should be done within 30 days of reaching this revenue threshold.

Key Document checklist for Your Thai Foreign Company Setup Process

| Step | Key Document Checklist | |

| 1. Company Registration with DBD – At least 2 million THB registered capital per foreign employee – A reduced capital requirement of 1 million THB per foreign employee if the foreign employee is married to a Thai national |

– Company name reservation form | |

| – Memorandum of Association (MOA) | ||

| – Articles of Association (AOA) | ||

| – Company location and address | ||

| – List of shareholders | ||

| – Details of directors | ||

| – Registered office address proof | ||

| – Copies of ID cards/passports (shareholders & directors) | ||

| – Application form for company registration | ||

| 2. Start Hiring & Social Security Registration | – Company registration certificate | |

| – List of employees | ||

| – Employees’ ID cards | ||

| – Social Security Fund registration form (Form SSO 1-01) | ||

| – Power of attorney (if applicable) | ||

|

– Monthly payroll records | |

| – Social Security Fund contribution receipts | ||

| – Payroll tax payment receipts | ||

| – Employee salary slips | ||

| 4. Submit and Complete Foreign Business License (FBL) Application / US Treaty of Amity application | – FBL application form | |

| – Company registration documents | ||

| – List of shareholders | ||

| – Details of business activities | ||

| – Business plan | ||

| – Financial statements/projections | ||

| – Power of attorney (if applicable) | ||

| – Supporting documents for foreign ownership necessity | ||

| 5. Apply for Work Permit and Visa | – Company registration documents | |

| – List of shareholders | ||

| – VAT certificate (if applicable) | ||

| – Social Security Fund payment proof | ||

| – Employment contract | ||

| – Passport copy of foreigner | ||

| – Non-Immigrant “B” visa | ||

| – Education and experience certificates of foreigner | ||

| – Passport-sized photos (3×4 cm) | ||

| – Medical certificate (from Thai doctor) | ||

| – Power of attorney (if applicable) | ||

| 6. Open the Company Bank Account | – Company registration certificate | |

| – Company affidavit (issued within past 3 months) | ||

| – Tax ID card | ||

| – Board of directors’ resolution (approving account opening) | ||

| – Copies of directors’ passports/ID cards | ||

| – Company seal (if any) | ||

| 7. VAT Registration | – Company registration documents | |

| – Company affidavit | ||

| – Lease agreement for office premises | ||

| – Map of office location | ||

| – Photos of office | ||

| – List of shareholders | ||

| – ID cards/passports of directors | ||

| – Power of attorney (if applicable) |

While the checklist for a Thai foreign company setup may seem extensive, each step is a clear milestone on your path to success in Thailand. You don’t have to navigate this journey alone. The expert team at SMEBAAS.com is dedicated to making this process seamless and efficient for you. We manage the intricate paperwork and legal procedures, so you can focus on what you do best—growing your business. Contact SMEBAAS.com today, and let us make your vision for a thriving company in Thailand happen.

GET A FREE QUOTATION ... CLICK HERE!