For any business in Thailand, managing the flow of essential sales documents is fundamental to success. Issuing clear, professional, and compliant paperwork not only ensures you get paid on time but also builds client trust and keeps you in good standing with the authorities. Consequently, understanding these essential sales documents is not just an administrative task; it is a core business function. This article explains the key essential sales documents—from quotation to receipt—highlighting the critical information and handling procedures for each, especially the strict rules for tax invoices set by the Thai Revenue Department.

The Foundational Sales Flow: From Offer to Payment

Before diving into individual documents, it’s helpful to understand their logical sequence. The process typically begins with an offer and concludes with proof of payment, confirming that goods were delivered along the way. For instance, you first send a quotation. Upon agreement, you issue a delivery note when you send the goods. Following that, you issue an invoice to request payment. Finally, upon receiving funds, you provide a receipt. The complete flow is: Quotation -> Delivery Note -> Invoice -> Receipt.

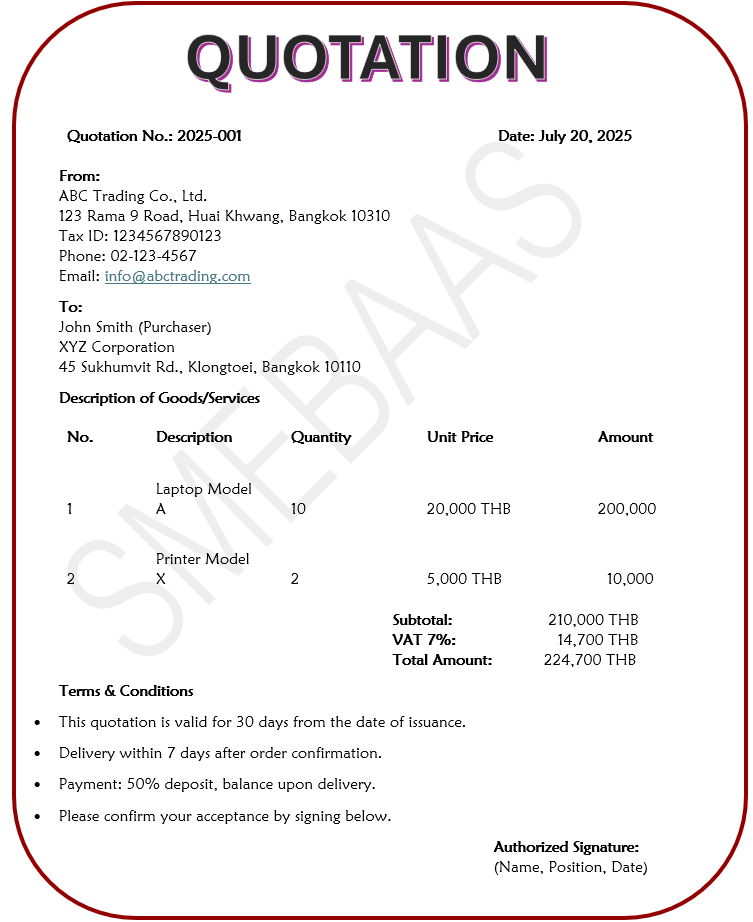

1. The Quotation (ใบเสนอราคา)

A quotation is your formal offer to a client. It details the products or services you will provide and at what cost. Therefore, its primary purpose is to establish clear expectations and prevent future disputes. A well-prepared quotation demonstrates professionalism and transparency from the very beginning.

Information to Include in a Quotation:

-

Your Company Details: Name, address, phone number, and Tax ID number.

-

Client’s Details: Name and address of the person or company.

-

Quotation Number: A unique identifier for tracking purposes.

-

Date of Issue: The date the quotation was created.

-

Detailed List of Goods/Services: Clear descriptions, quantities, and unit prices.

-

Total Amount: The subtotal, any applicable VAT (Value Added Tax), and the final grand total.

-

Validity Period: The timeframe for which the quoted price is valid (e.g., “Valid for 30 days”).

-

Terms and Conditions: Payment terms, delivery schedule, and any other relevant conditions.

2. The Delivery Note / Delivery Order (ใบส่งของ)

After a client accepts the quotation and you are ready to ship the products, the Delivery Note becomes crucial. This document accompanies the goods and serves as a checklist for the recipient. Essentially, its primary function is to act as proof of delivery. When the client signs this document, they are formally acknowledging that they have received the items listed.

Information to Include in a Delivery Note:

-

Your Company Details: Name and address.

-

Client’s Details: Name and the specific delivery address.

-

Document Number: A unique Delivery Note number.

-

Date of Delivery: The date the goods were dispatched or delivered.

-

List of Goods Delivered: A clear description and quantity of each item. Prices are often omitted from a pure delivery note but can be included.

-

Cross-Reference: Reference the related Quotation or Invoice number for easy tracking.

-

Recipient Signature Area: This is the most important part—a space for the recipient’s name, signature, and the date to confirm receipt of the goods in good condition.

Furthermore, to streamline paperwork, many businesses combine the delivery note and invoice into a single document, often titled “Invoice / Delivery Note” (ใบแจ้งหนี้ / ใบส่งของ).

Document Handling:

Typically, two copies are prepared. The customer signs both upon receiving the goods, keeping the copy (สำเนา) for their records and returning the original (ต้นฉบับ) to your delivery person. Keep this signed original as your definitive proof of delivery and file it carefully.

3. Tax Invoice (ใบแจ้งหนี้) /Tax Invoice (ใบกำกับภาษี): An Essential Sales Document for VAT-Registered Businesses

After the delivery of goods and the signing of the delivery note, issue an invoice as the next step. A business sends an invoice as a formal request for payment after delivering goods or services. An invoice is a In Thailand, a non-VAT registered business would issue a standard Invoice/Bill. However, for VAT-registered businesses, this document is often combined with a tax invoice.

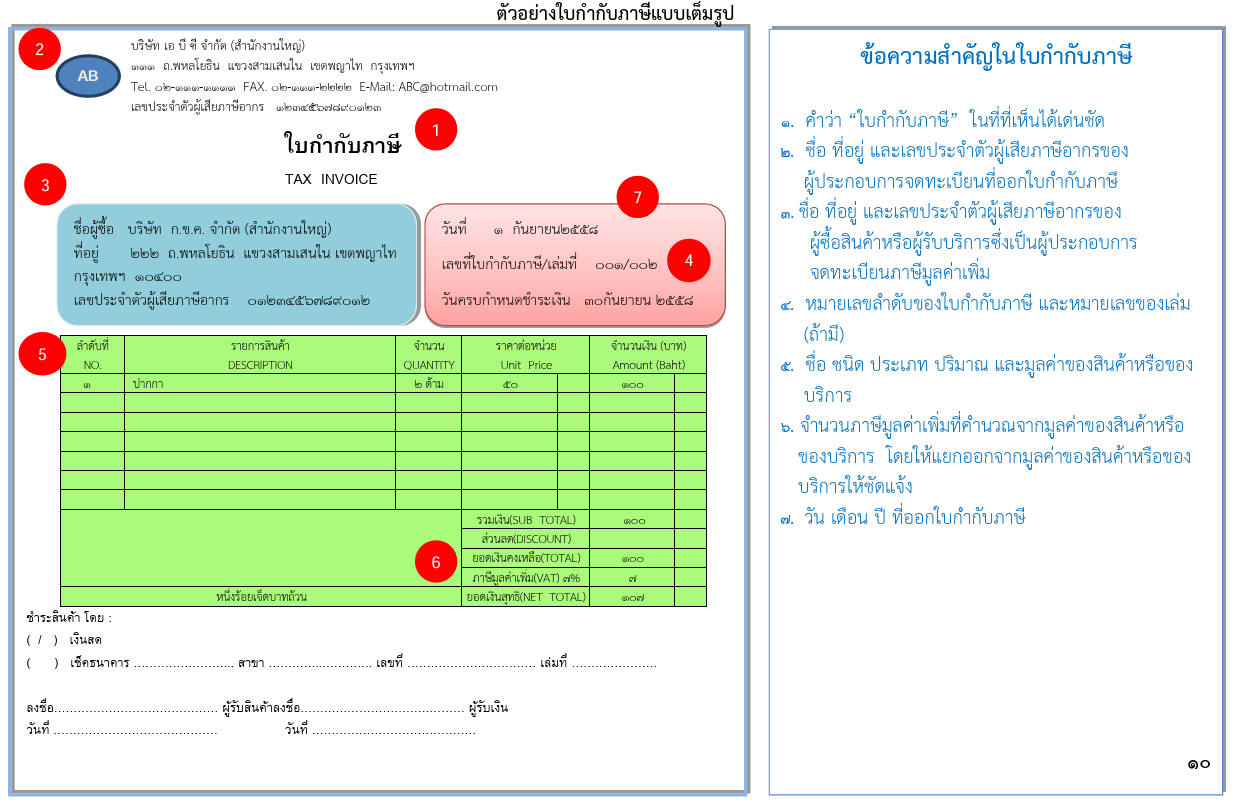

This document stands out as the most critical sales document for any VAT-registered business in Thailand. The Tax Invoice (ใบกำกัภาษี) must comply with strict guidelines by the Thai Revenue Department, as it is legally mandated. Failure to comply can lead to penalties and issues for both you and your client, who needs it to claim input tax.

Mandatory Information for a Full Tax Invoice (ตามมาตรา 86/4)

A tax invoice accepted by the Revenue Department (full tax invoice) must contain the complete details as prescribed by law, as follows:

-

The phrase “Tax Invoice” in a clearly visible position.

-

Name, address, and taxpayer identification number (TIN) of the VAT-registered business issuing the tax invoice.

-

Name and address of the purchaser or service recipient (and their taxpayer identification number, if the purchaser is required to have one).

-

Consecutive number of the tax invoice and book number (if applicable).

-

Name, type, category, quantity, and value of the goods or services.

-

Amount of Value Added Tax (VAT) calculated from the value of the goods or services, shown separately from the price of the goods or services.

-

Date (day, month, year) on which the tax invoice is issued.

-

Other information as determined by the Director-General, e.g., in the case of a head office or branch, specify “Head Office” or “Branch No. …” as registered with the VAT office.

-

Language: Must be in Thai. Using both Thai and English is allowed. Use of other languages is subject to approval by the Director-General.

-

Currency unit: Must be in Thai Baht. Arabic or Thai numerals may be used.

Notes

-

Tax invoices lacking any of the above required particulars may not be accepted by the Revenue Department and VAT input tax credit can be denied.

-

There must be no erasure, alteration, or deletion of details in the tax invoice.

Document Handling:

When issuing a tax invoice, you must prepare at least two copies. The original (ต้นฉบับ) must be sent to the customer, as they require it for their VAT claims. Importantly, you must keep the copy (สำเนา) for your own records and for potential inspection by the Revenue Department for a minimum of 5 years.

4. The Receipt (ใบเสร็จรับเงิน)

Finally, after you receive payment, you must issue a receipt. A receipt is the client’s proof that they have settled the invoice. It finalizes the transaction and is crucial for their accounting records.

What to Include in a Receipt:

-

Your company name, address, and Tax ID.

-

The client’s name.

-

A unique receipt number.

-

The date of payment.

-

A reference to the original invoice number.

-

A description of what the payment was for.

-

The amount received, written in both numbers and text (e.g., 1,500.00 บาท (หนึ่งพันห้าร้อยบาทถ้วน)).

-

The signature of the authorized recipient of the funds.

Document Handling:

As with other final documents, the original receipt (ต้นฉบับ) must be given to the customer as their official proof of payment. You must always retain the copy (สำเนา) for your financial records to complete the transaction trail for both parties. In many cases, stamping “Paid” or “Received” (ชำระแล้ว) on the original tax invoice can serve as both a tax invoice and a receipt for the customer, though you should still keep a copy of this paid document for your records.

Managing all these essential sales documents can be a time-consuming and complex task. If you find yourself overwhelmed by this administrative burden, remember that services like SMEBAAS can assist you. While we offer comprehensive bookkeeping, we can also provide additional support to ensure all your documents are correctly prepared and compliant, freeing you up to focus on growing your business.

GET A FREE QUOTATION FROM SMEBAAS... CLICK HERE!!